The demand and supply of various links in the first half of the year have already been implemented. Generally speaking, the demand in the first half of 2022 far exceeds expectations. As the traditional peak season in the second half of the year, it is expected to be even more popular.

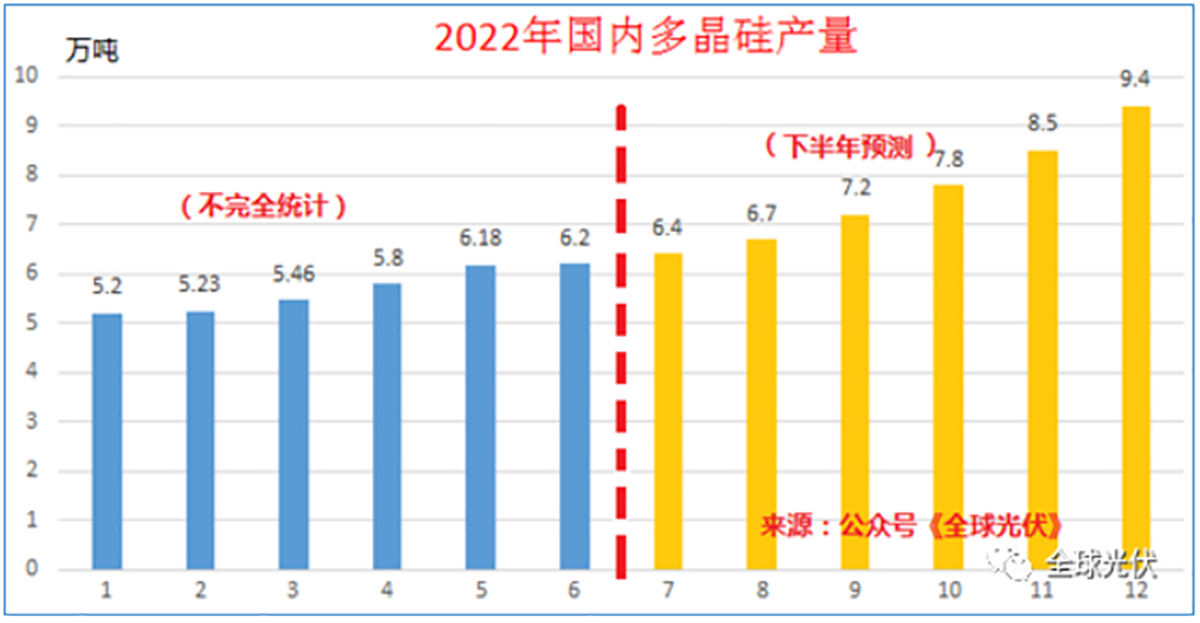

1. 1-6Monthly polysilicon supply and demand forecast

In June 2022, my country's polysilicon production reached a record high of 62,000 tons; from January to June, polysilicon production showed a steady upward trend. However, due to the East Hope fire accident and the overhaul of some production lines in June, the growth rate of polysilicon production slowed down in June.

According to the latest report of the Silicon Industry Branch, domestic polysilicon production is expected to increase by 120,000 tons in the second half of 2022 compared with the first half of the year. In Q3, due to the impact of temperature and maintenance, the increase is small, and the main increase occurs in the fourth quarter, while the output in the fourth quarter The market demand contribution in 2022 is relatively small.

From January to June, the domestic output was about 340,000 tons, and the total supply was about 400,000 tons. Among them, although domestic production is still increasing in May-June, imported polysilicon has been greatly affected by the domestic epidemic and foreign wars (Russian-Ukrainian conflict), resulting in a serious shortage of polysilicon supply. , the continuous increase in May-June was almost double the previous increase in January-April.

In the second half of the year, it is expected that the demand for polysilicon in my country will reach 550,000 tons, an increase of 34% over the first half of the year, and the annual demand will reach 950,000 tons. However, the annual domestic polysilicon production is only 800,000 tons, the import volume is about 100,000 tons, and the total supply is 900,000 tons. If the period from November 2021 to October 2022 is used as the supply cycle of polysilicon to the installed capacity in 2022, the effective supply for the whole year is about 800,000 tons.

2. Polysilicon profitability increased several times

The supply and demand of polysilicon in 2022 will remain in short supply, and the average price of polysilicon is expected to reach more than 270 yuan/kg, which is much higher than the average price of polysilicon in 2021.

Industrial silicon and silicone prices have started to come down in the past two weeks, so the cost of polysilicon may not rise any more, and profit margins will improve significantly. Both volume and price have risen, and the profits of polysilicon companies this year may be 3-5 times that of last year.

3. Annual new PV and module supply

The supply of 800,000 tons of polysilicon corresponds to a module output of about 310-320 GW. After deducting the safety stock in each link of the industrial chain, the modules that can be supplied to the terminal will be within 300GW, corresponding to 250GW of new global photovoltaic installed capacity.

Since the global polysilicon supply in 2021 still has a surplus compared to the annual 190GW module shipments, this surplus will be converted into safety stocks brought about by the expansion of wafers, cells, and modules in 2022, so the 250GW increase PV installed capacity will be a neutral forecast for 2022. If each link can strengthen inventory management, reduce safety stocks, and the polysilicon import link can be further improved, then the annual polysilicon supply is expected to increase further, and the corresponding module shipments are expected to reach more than 320GW. The optimistic expectation of installed capacity is still around 270GW.

Post time: May-16-2023